The Eagle Hill Consulting Employee Retention Index

April 2025 release

Uncover emerging trends. Anticipate shifts in retention. Keep your best people.

Employee Retention Index ticks higher as employee outlook of job market dips

The Employee Retention Index gains 3.9 points to 102.5 as U.S. employee confidence in their employers and satisfaction with current jobs rises, but their optimism about the external market wanes. This signals that U.S. employees are more likely to stay in their jobs over the next six months. Despite this upward shift, the Index remains below the peak observed in Q2 2024, continuing a broader downward trend.

Following the Index’s peak in the second quarter of 2024, it lost 6.6 points across the following two quarters. This was a signal that quits would begin increasing in the first half of 2025. This aligns with economic data from The Bureau of Labor Statistics Job Openings and Labor Turnover Survey (JOLTS), which finds that the U.S. employee quit rate rose in January and February to 2%, up from 1.9% in December.

Employees’ perception of the external job market has declined, reflecting ongoing volatility in how workers view job opportunities beyond their current roles. On the other hand, employee confidence in their organizations has strengthened, with improvements in satisfaction and outlook related to compensation, as well as a renewed sense of connection to workplace culture.

Latest retention indicators

+3.9

Employee Retention Index

+2.7

Organizational Confidence

+2.6

Culture

+3.3

Compensation

-2.4

Job Market Opportunity

Key employee retention insights

Looking at segments of the U.S. workforce, the Employee Retention Index signals the employees most likely to stay in their current roles in the coming six months include Gen Z (Retention Index of 112) and men (111.9). Meanwhile, the groups most inclined to leave their jobs will be Millennials (99.9) and women (92.9).

As employee optimism about the external job market wanes, confidence and satisfaction with current jobs rise

U.S. employees are more pessimistic about employment opportunities available in the market. The Job Market Opportunity Indicator declined by 2.4 points to 99.6. This shift continues to reflect employees’ more volatile perception of the market dating back to early 2024.

While employee outlook towards external market factors diminishes, improved perceptions of internal retention drivers like culture, compensation, and confidence indicate that employees are more content in their current roles.

The Compensation Indicator rose 3.3 points, the largest shift among the four indicators, demonstrating renewed satisfaction with current compensation and earnings potential. The Organizational Confidence Indicator, reflecting employee confidence in their leadership and organizational outlook, increased by 2.7 points. The Culture Indicator also increased 2.7 points, showing signs of recovery following a sharp decline last period. That said, employers should continue to maintain a close eye on their culture given its position as the weakest internal-focused indicator for four consecutive quarters.

Lean into Gen Z’s rising loyalty

Gen Z workers are the generation most likely to stay in their current jobs – and more so than ever before. Their Retention Index has reached a record high of 112, gaining a significant 17.2 points. Gen Z is the only generation whose retention outlook has consecutively improved in the last two periods, signaling an upward trend in their intention to stay in their jobs.

Gen Z’s Organizational Confidence Indicator also rose (13.9 points), outpacing every other generation by more than 16 points. Their Compensation Indicator improved by 13.3 points, reflecting a lead of over 15 points compared to their peers. Additionally, Gen Z’s Culture Indicator rose by 9.4 points. Despite their Job Market Opportunity declining by 14.3 points, Gen Z remains the most optimistic about the job market compared to other generations.

Figure 1. Gen Z is increasingly confident, satisfied, and likely to stay in their current roles

3-month and 12-month change

Source: Eagle Hill Consulting Employee Index, 2025-Q1

Millennials, on the other hand, pose the largest retention risk in the months ahead. Additionally, Millennials are the only workforce demographic group surveyed to report a weakened Retention Index, dropping 8.8 points to 99.9. This marks Millennials’ second consecutive decline, reversing their steady gains since the fourth quarter of 2023.

Gen X and Baby Boomer employees hold the middle-ground positions in the Retention Index at 100.8 and 102.6, respectively.

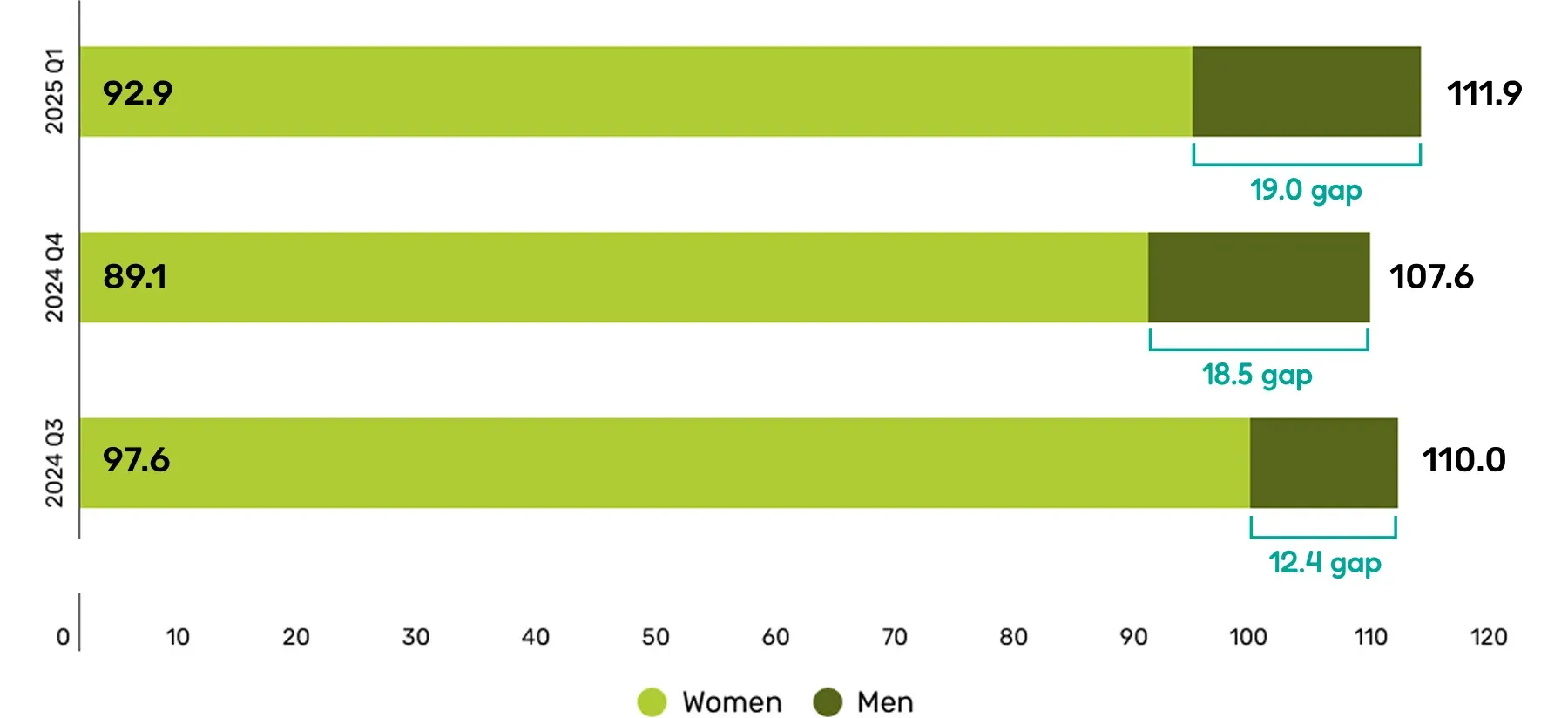

The gender retention gap continues to expand, reaching its widest point

The Retention Index shows the widest gender divide ever, a 19-point gap. Both men and women saw comparable increases in their Retention Index scores, with men rising by 4.3 points and women by 3.8 points. Despite these similar gains, the retention outlook gap continues to widen. Male versus female perceptions of their compensation, reflected in the Compensation Indictor, has diverged more than ever to 33.2 points, while the Organizational Confidence gap has grown to 17.8 points.

Figure 2. The Employee Retention Index shows a persistent and widening gender gap

Source: Eagle Hill Consulting Employee Index, 2025-Q1

For women, the Retention Index rose to 92.9, with the strongest sentiment in workplace culture and the weakest in compensation. Women saw improvements in all indicators except Job Market Opportunity. Meanwhile, the Retention Index for men increased to 111.9, with compensation being their strongest sentiment area and culture and job market opportunity as the weakest. Like women, men saw improvements in all indicators except Job Market Opportunity.

Gen Z is sticking around—here’s how to make it count

Gen Z is the fastest-growing generation in the workforce. Retaining them is a critical strategy for future proofing your organization. New research reveals a trend of rising Gen Z organizational loyalty. Learn why and explore key priorities that influence Gen Z retention.

Blog

Harness the Gen Z loyalty surge: A playbook

Gen Z’s digital prowess and fresh perspectives are high-value in today’s innovation-driven economy, uniquely positioning Gen Z to power organizations into the future.

Article

Four Gen Z employee retention strategies

Amid an environment of budget and headcount cuts, Gen Z loyalty stands out from other generations. Don’t miss the opportunity to secure the talent necessary to thrive in a competitive marketplace.

Expert insights

Melissa Jezior

President & CEO

“The Eagle Hill Employee Retention Index comes at an important moment for the U.S. economy and businesses, providing timely insight for employers considering changes to their workforce amid economic headwinds. The data indicate that employees are more to stay put in the coming months, and there’s a rising sense of unease among workers regarding job prospects. It also sheds light on which employers might be easiest to retain and those more likely to leave.”

Track. Assess. React.

The first of its kind, the Eagle Hill Consulting Employee Retention Index tracks quarterly sentiment of U.S. workers across four proven drivers of employee retention, which compose the Index’s indicators:

- Organizational Confidence: measures how confident employees are in their organization’s future and their organization’s leadership.

- Culture: measures how employees feel about their workplace culture, connections, feeling valued and recognized.

- Compensation: measures how employees view their compensation, benefits, and ability to grow their compensation at their organization.

- Job Market Opportunity: measures how employees perceive external prospects for employment and job security in the near term.

As the Employee Retention Index increases, it signals an increase in workforce retention in the next six months. As the Index decreases, it warns employers that workers are more likely to leave their jobs, and organizations can expect more turnover in the months ahead.

Methodology

The Index is based on a monthly omnibus survey conducted by IPSOS of a nationally representative sample of U.S. adults employed full or part time. Quarterly indices and reports are issued based on a minimum of 1,200 aggregated responses per quarter. Respondents are polled on a range of workforce topics including organizational confidence, culture, compensation, and job market opportunity.

Related resources

Unlock the power of your people with our insights and library of content designed to drive employee retention and engagement.