Report

The wallet. The weekend. The workplace: How employers can win top technology talent in Seattle

Seattle is the nation’s fastest-growing city. The real estate market is booming. Cost of living is skyrocketing. Tech talent is descending in droves as the Silicon Valley set moves engineering hubs into town.

With such fierce competition for talent, how can Seattle’s employers—big and small, tech and traditional—attract and retain the best people?

36%

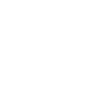

of Seattle’s workforce says that financial security is the top factor for work-life balance.

Eagle Hill Consulting surveyed employees in the Seattle area to understand their work-life balance priorities in this unique market. The majority rank financial security as the top factor for maintaining a positive work-life balance. And despite the mythology surrounding millennials, their views actually echo those of people in older generations.

Seattle has so much more to offer than a great cup of coffee. A vibrant culture. Breathtaking natural beauty. A healthy economy. But the city is a study in contrasts. It is a jobseeker’s paradise for many, but real estate prices freeze people out of the market. It is a place where employees work hard all week, but completely unplug for the weekend. It has an entrepreneurial vibe, but start-ups have to battle with giants like Amazon, Microsoft and Google for talent. These opposing forces create tension between the wants and needs of the city’s employees and employers, making Seattle a one-of-a-kind employment market.

The wallet: financial security matters the most

Financial security is the foundation for work-life balance for people in Seattle. 36 percent say it is the top factor. Compare that to just 28 percent nationwide. In fact, Seattleites say financial security is twice as important as all other factors, which include hours worked, physical/emotional wellness, schedule flexibility, commuting time and working from home (see Figure 1).

While millennials have the reputation for craving workplace perks—think open workspaces or beanbag chairs—they prioritize compensation in Seattle when it comes to work-life balance. 34 percent of Seattle’s millennials cite financial security as the top driver. And they are willing to work for it. 87 percent of millennials say they would prefer higher pay and more hours in their current job rather than lower pay and fewer hours, compared to 78 percent of non-millennials.

It is not so surprising that Seattleites of all ages emphasize financial security considering what it costs to live in the city. The cost of living is 24 percent higher than the national average (PayScale Cost of Living Calculator). So people need to be financially secure, in terms of salary and compensation, just to live in the city comfortably, let alone to enjoy everything that the Seattle area has to offer outside of the office.

Melissa Jezior talks about the Seattle War on Talent

Work-life balance is the healthy blend of employees’ professional and personal responsibilities. The balance naturally skews one way or the other on any given day. What is critical is that employees have the support, control and flexibility to succeed in both areas over the long term.

The weekend: work to live is the mantra

This dynamic suggests that financial security is a priority because it is the means to the end for work-life balance among the workforce in Seattle. In this work hard to play hard town, it is impossible to be a weekend warrior if you have to work a second job to cover the mortgage instead of heading to the mountains on Friday after work.

It is not that other factors such as length of the work week, flexibility and telework options do not matter to people when they assess employers and employment options. They certainly do. But these factors have become table stakes in recent years. What used to be competitive advantages in company culture and compensation are now the competitive baseline for employers in Seattle.

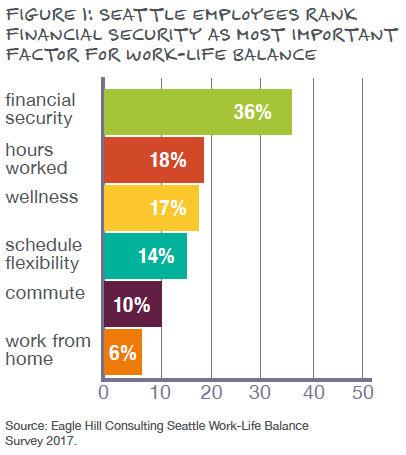

Seattle’s employers are already succeeding at delivering this baseline. Roughly nine in 10 Seattle employees say they have a good work-life balance today (see Figure 2). However, if employers do not offer a great workplace, flexibility—and financial security too—employees will find it somewhere else. Consider that more than one-quarter (27 percent) of the city’s workforce is likely to leave their job this year. Some employers may increasingly find themselves in the position to differentiate employment offers on salary, total compensation and financial rewards for top talent.

The workplace: what makes it different makes it better

In this tough environment, differentiation—with an emphasis on financial security—is critical for employers to compete and scale. Major technology players have a strong track record here, and companies across sectors can look to them for good ideas and best practices in these important areas:

- SHOW THEM THE MONEY

Companies must stay ahead of the curve in identifying and financially rewarding top performers through a competitive salary and financial benefits including equity and student loan assistance. The golden rule for today’s employers? Do not compromise on financially rewarding your most valuable people. As part of Google’s compensation strategy, the company “unfairly” rewards top performers up to ten times higher pay than satisfactory performers in the same role. As another example, rather than adjusting employee salaries along internal pay grades, Netflix sets employees’ pay higher than market value to attract and retain the best people. Netflix employees then select how their salary is allocated across cash and equity. - PUT IT IN WRITING

The employee value proposition (EVP) defines what differentiates a company. The EVP is a touchstone of the corporate identity and employment brand. It should be written down and publicly available. Gone are the days where an effective EVP meant touting ping-pong tables, free lunches and flex schedules. Now more than ever, companies must highlight what they do to provide financial security to their people as a central part of the EVP. Getting this right in the EVP is critical to how employees, prospects and the market perceive and evaluate a company. Always a trendsetter, Apple added education reimbursement, non-profit donation matching and longer parental leave to its list of benefits to further differentiate from competitors and attract top talent.

THE 5 C’S OF A WINNING EMPLOYEE VALUE PROPOSITION

When crafting your employee value proposition, start with the 5 C’s. Eagle Hill Consulting’s employee value proposition articulates our distinct employment brand and demonstrates the five critical elements that every EVP should have.

- PULSE YOUR PEOPLE

Communications about the employee experience should be two-way and ongoing as opposed to periodic mandates handed down to staff from the C-suite. Winning companies continuously seek feedback from employees about why they work for the company and what matters most to them, including financial security. These companies also engage employees in understanding how to keep improving the environment to remain competitive in the war for talent. Microsoft asks for—and acts on—employee feedback through an annual poll in addition to quarterly “pulse polls” on specific issues. Companies can gather feedback through casual conversations around the workplace and/or by using technology tools like TinyPulse, WooBoard and HappyMeter that measure employee engagement.

Methodology

The online survey included 505 private sector employees in the Seattle area. The survey results were weighted to reflect U.S. demographic factors, including age, income, and gender. The Eagle Hill Consulting Seattle Work-Life Balance Survey 2017 was conducted by Ipsos in January 2017.