Eagle Hill Consulting Employee Retention Index holds steady for third quarter, but signals sustained lower worker turnover could increase through early 2025

Male, Millennial and Baby Boomer employees most likely to stick with employers; government employee results consistent with national results

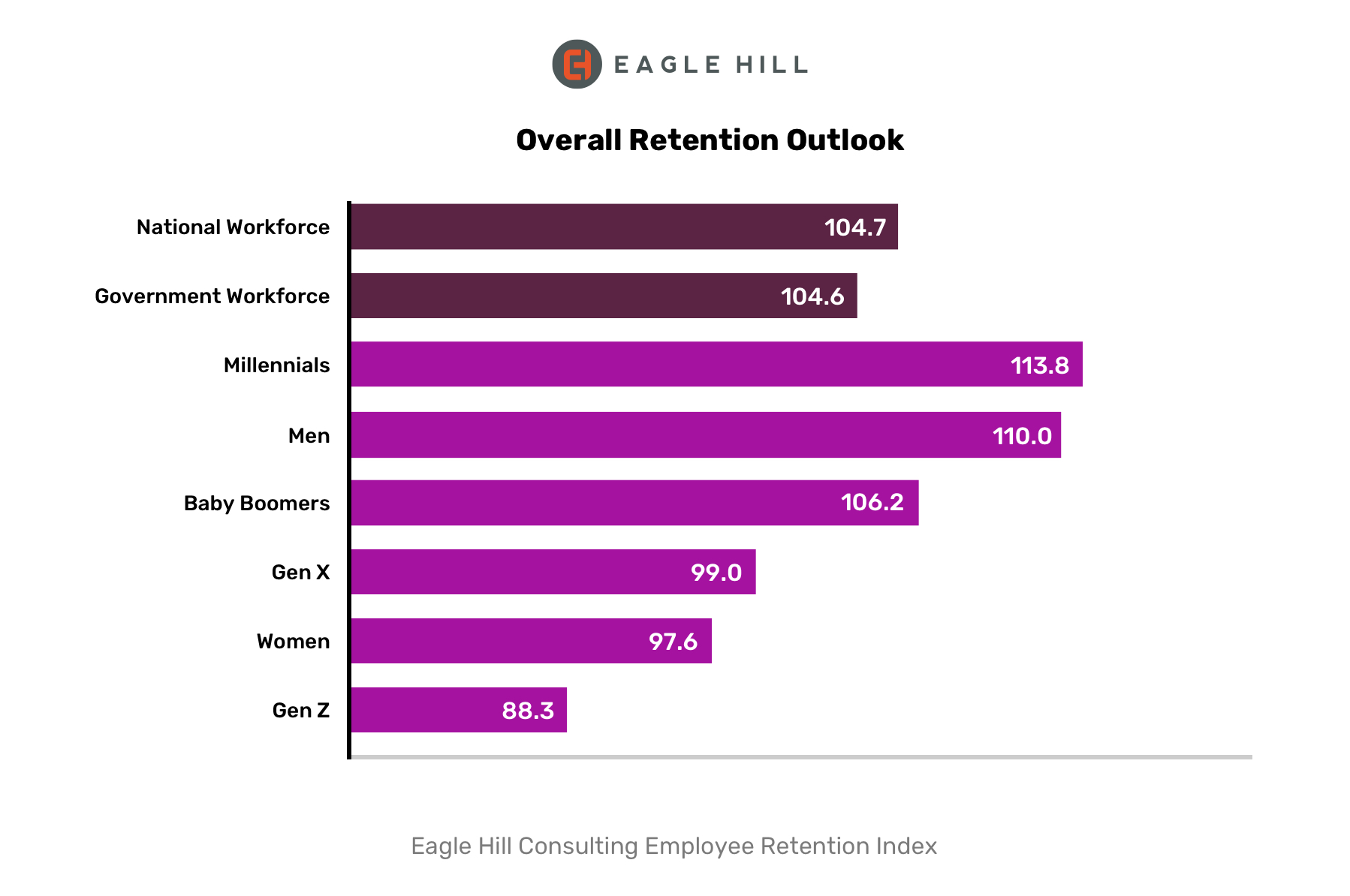

Arlington, VA, October 10, 2024 – The Eagle Hill Consulting Employee Retention Index held steady for the third quarter of 2024, decreasing by less than half a point to 104.7 from 105.1 from the previous quarter. While employee attrition rates have been falling this year, the Employee Retention Index signals that more workers could leave their jobs through early 2025 after several quarters of declining attrition.

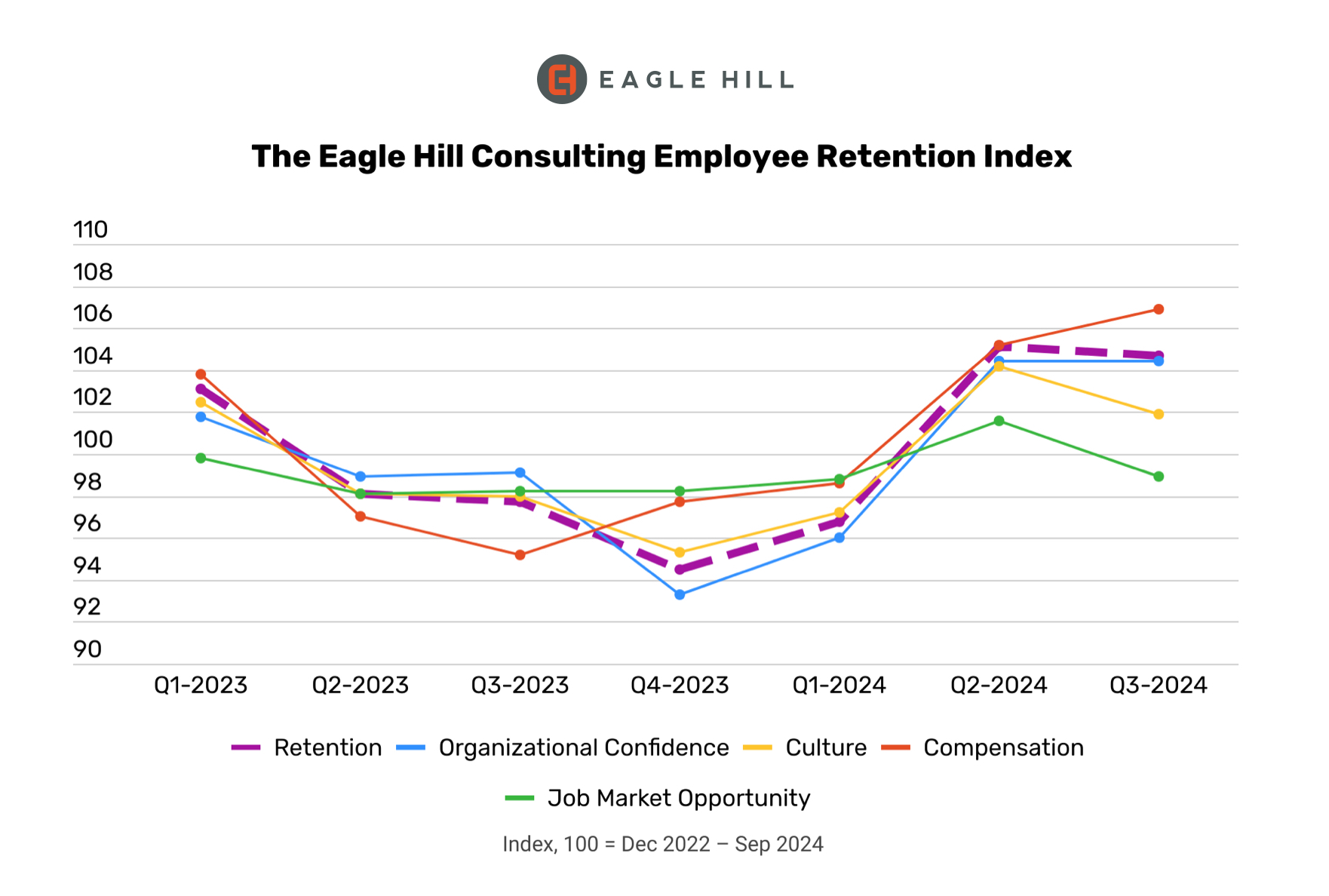

Notably, the Q3 2024 Employee Retention Index found employee confidence in their organization’s culture and compensation remain strong, which hit peaks the last quarter. Employee optimism related to compensation continued to climb, up 1.7 points, while employees’ confidence in their organization and leadership held steady at 104.4. Worker attitudes regarding their workplace culture declined by 2.3 points while optimism around workers’ near-term outlook for the job market saw the largest decline, unraveling gains from the last quarter.

The Employee Retention Index comes on the heels of two key U.S. economic reports, and the Index results are largely aligned with this new jobs data. The latest Bureau of Labor Statistics Job Openings and Labor Turnover Survey (JOLTS) data for August found that employers backed off in hiring, and more workers are staying in their jobs. JOLTS reported that the number of employees voluntarily quitting their jobs fell to 3.08 million, the lowest level since September 2020. Meanwhile, the Department of Labor reported that employers added 254,000 jobs in September, far more than projected, while the unemployment rate unexpectedly ticked lower, down to 4.1 from 4.2 percent the month prior. The agency also reported that worker wages increased 0.4 percent for the month, rising to four percent year over year.

“The results of Eagle Hill’s latest Employee Retention Index indicate that it’s an opportune time for organizations to focus on strategic initiatives,” said Melissa Jezior, president and chief executive officer of Eagle Hill Consulting. “With a robust economy and stable workforce, employers can take the long view on strategic priorities and even tackle issues that are more difficult to address – from operational efficiencies to reorganizations.”

Looking at various demographics, the Employee Retention Index found workers who are most likely to stay in their jobs are Millennial (113.8), male (110), and Baby Boomer (106.2) employees. On the flip side, Gen Z (88.3) and female (97.6) employees are more likely to leave. When looking at government employees, the Index results generally were consistent with the national data. Government employees were slightly more pessimistic across all four indicators, with the highest variance in Job Market Opportunity, which was 5.2 points lower than national workforce sentiment.

“Another key takeaway from Eagle Hill’s Employee Retention Index is that employers who want to retain female and Gen Z workers should consider doubling down on engaging with those employees because our data indicates they are most at risk of leaving,” said Melissa Jezior, president and chief executive officer of Eagle Hill Consulting. “That means digging in to understand the unique needs and preferences of these employees and taking any needed action to meet them where they are. For example, women and Gen Z employees often place a high value on workplace culture, flexibility, career development, and feeling connected to their work. If you’re not delivering on those measures, women and younger workers are at a higher risk of leaving regardless of the job climate.”

“And just a word of caution. While the workforce attrition levels are lower, this does not mean employers should retreat from monitoring their employee sentiment and managing employee engagement initiatives. We know all too well that economic conditions can change in an instant,” Jezior said.

The Eagle Hill Employee Retention Index is a first-of-a-kind market indicator that provides employers with early signals of U.S. workers’ likelihood to leave or stay at their job. It tracks worker sentiment across four proven drivers of retention: organizational confidence, culture, compensation, and job market opportunity.

Each month, the Eagle Hill Consulting Employee Retention Index forecasts shifts in workforce retention based upon ongoing employee opinion surveys on factors that directly correlate with employees’ intentions to make job moves:

- The Organizational Confidence Indicator measures how confident employees are in their organization’s future and leadership. For Q3 2024, this measure held steady at 104.4.

- The Culture Indicator looks at how employee sentiment about their workplace culture, connections, and whether they feel valued and recognized. For Q3 2024, this measure dipped from 104.2 to 101.9.

- The Compensation Indicator measures how employees view their compensation, benefits, and ability to grow their compensation at their organization. For Q3 2024, this measure rose from 105.2 to 106.9.

- The Job Market Opportunity Indicator measures how employees perceive external prospects for employment and job security in the near term. For Q3 2024, this measure had the most volatility, dropping from 101.6 to 98.9.

Read more about the Eagle Hill Consulting Employee Retention Index findings.

Each month, the Eagle Hill Consulting Employee Retention Index forecasts shifts in workforce retention based upon ongoing employee opinion surveys on factors that directly correlate with employees’ intentions to make job moves. As the Employee Retention Index increases, it signals an increase in retention in the next six months. As the Employee Retention Index decreases, it signals to employers that workers are more likely to leave their jobs, and organizations can expect more turnover in the next six months.

Understanding employee sentiment at a deep level has evolved into a competitive asset. With this new proprietary market indicator, employers have forward-looking insights to help proactively implement strategies to manage their workforce. While the Eagle Hill Employee Index isn’t a one-size-fits-all for employers, organizations can use it to benchmark their organization and pinpoint their strengths and weakness. In doing so, employers can assess and make changes to ensure their workforce is motivated, engaged, and aligned with the organizational mission.

Results are released on a quarterly basis, including an annual summary report. Conducted by Ipsos, the Eagle Hill Employee Retention Index is a nationally representative sample of adults ages 18 and older who are employed full-time or part-time on a range of workforce topics. Survey data is collected on a monthly basis, which commenced in December 2022. The most recent data was collected from September 3-4, 2024.

Eagle Hill Consulting LLC is a woman-owned business that provides unconventional management consulting services in the areas of Strategy, Performance, Talent, and Change. The company’s expertise in delivering innovative solutions to unique challenges spans across the private, public, and nonprofit sectors. A leading authority on employee sentiment, Eagle Hill is headquartered in the Washington, D.C. metropolitan area, with employees across the U.S. and offices in Boston and Seattle. More information is available at www.eaglehillconsulting.com.

Media Contact: Susan Nealon | 703.229.8600 | snealon@eaglehillconsulting.com | @WeAreEagleHill