Eagle Hill Consulting Employee Retention Index shows improved U.S. employee sentiment, signaling worker attrition could fall in the next six months

First quarter 2024 Index finds first upward shift in employee sentiment following a three quarter decline

Webinar on April 30th to review Index results and implications for employers

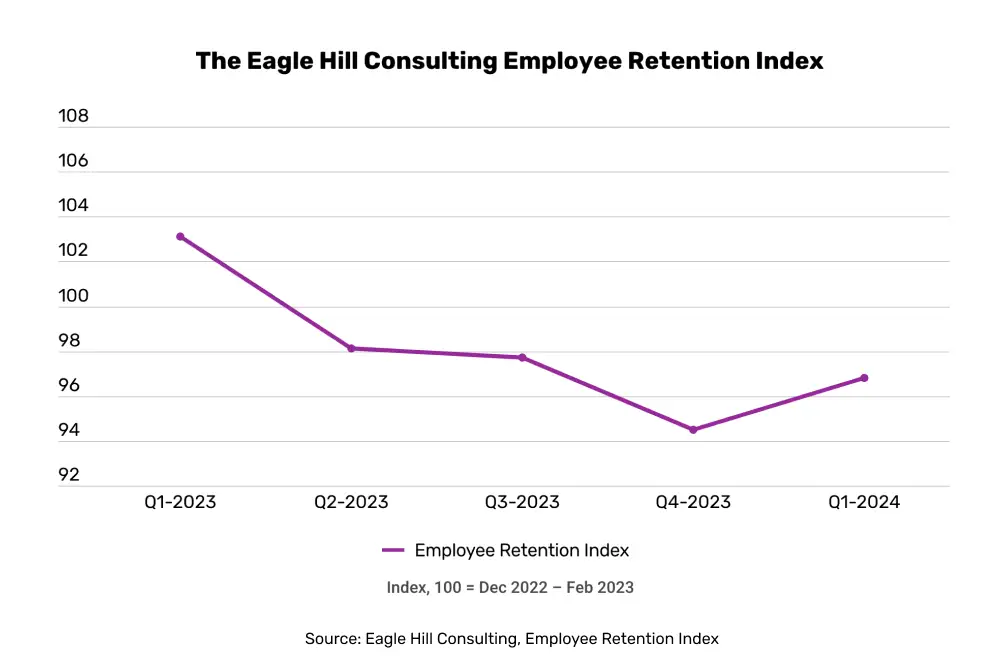

Arlington, Va., April 4, 2024 – The Eagle Hill Consulting Employee Retention Index for the first quarter of 2024 rose to 96.8, up from 94.5 in the fourth quarter of 2023, signaling that employers can expect workers will be less likely to leave their jobs in the next six months. Notably, the new Employee Retention Index results show a rebound in employee sentiment following a steady decline during the past three quarters.

The Employee Retention Index is a first-of-a-kind market indicator that provides employers with early signals of U.S. workers’ likelihood to leave or stay at their job. It tracks worker sentiment across four proven drivers of retention: organizational confidence, culture, compensation, and job market opportunity.

Register for a webinar on Tuesday, April 30, 2024, at 3:00 PM ET with a review of the latest Employee Retention Index findings and the implications for employers.

The first quarter results come on the heels the U.S. Labor Department Job Openings and Labor Turnover Survey (JOLTS) released Tuesday that found workers quits rate, a sign of confidence among workers, held at 2.2 percent for the fourth consecutive month. The hiring rate ticked up slightly to 3.7 percent in February, up from 3.6 percent in January.

“Eagle Hill’s latest Employee Retention Index shows an improvement in employee sentiment, interrupting a three-quarter decline and signaling that employee retention is expected to rise in the coming six months. Our employee sentiment data is aligned with economic data indicating that labor market conditions are cooling,” said Melissa Jezior, president and chief executive officer of Eagle Hill Consulting.

Jezior said, “This rebound in employee sentiment means employers now may have some breathing room as extreme labor shortages are easing and job quits are receding. It may be easier to fill jobs, perhaps we’ll see a cease fire on employee bidding wars, and fewer employees will resign. Under those conditions, productivity can improve as can the bottom line. However, this does not mean employers should retreat from monitoring their employee sentiment and managing employee engagement initiatives because economic conditions can change quickly.”

Despite the upward trajectory in employee sentiment, the Employee Retention Index signals employer caution. Year-over-year employee sentiment remains down, with the Employee Retention Index showing a loss of 6.3 points compared to the first quarter of 2023, the Index’s highest reading to date.

“For organizations looking to reduce their headcount, the new Eagle Hill data indicates these employers may face headwinds. These employers won’t be able to rely on attrition to reduce their workforce and could be in a situation where layoffs are the only option,” Jezior said.

Read more about the Eagle Hill Consulting Employee Retention Index findings.

Key takeaways of the most recent results for the first quarter of 2024 are as follows:

- The Eagle Hill Consulting Employee Retention Index edged up 2.3 points in the first quarter of 2024, up from 94.5. The is the first upward shift from the Index’s steady retreat. This upward trend signals employees are less likely to leave their jobs, and employers can expect lower attrition through the next six months of 2024.

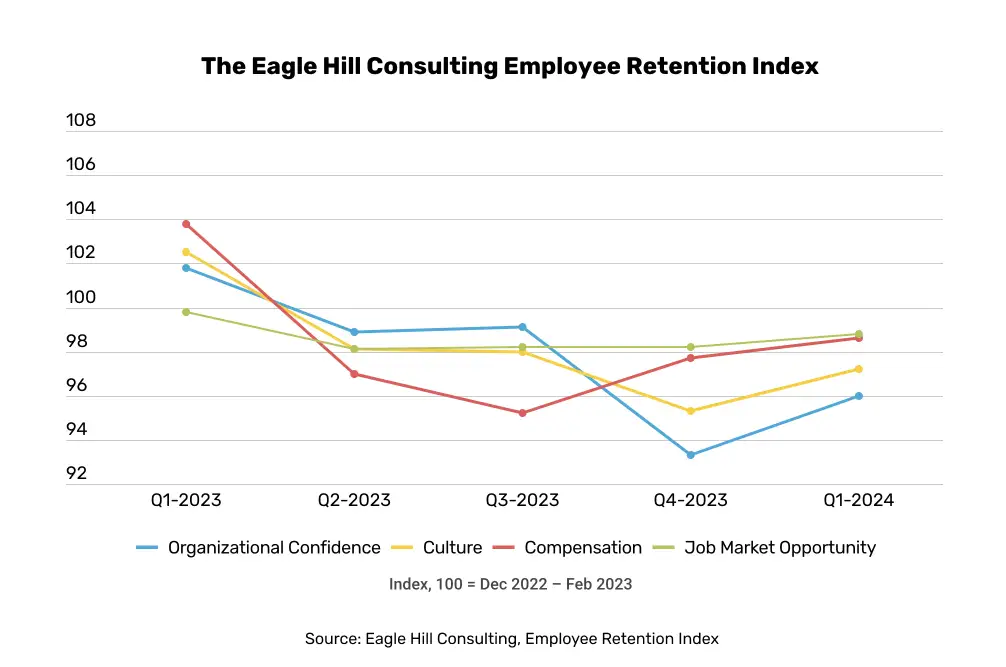

- The Organizational Confidence, Culture, and Compensation indicators increased in the first quarter of 2024, reflecting strengthening employee sentiment, while the Job Opportunity Index was virtually unchanged.

- The Organizational Confidence Indicator, indicative of workers’ confidence in their organization’s stability and leadership, increased to 96, up 2.7 points in the first quarter of 2024. Organizational Confidence saw the largest upward increase among the four indicators in the first quarter of 2024.

- The Culture Indicator, a reflection of workers’ satisfaction with cultural elements including connection, meaning and recognition, increased to 97.2 in the first quarter of 2024, up from 95.6 in the fourth quarter of 2023.

- The Compensation Indicator, demonstrating workers’ perception of their compensation and expectations of future growth, continued its steady rise to 98.6 in the first quarter of 2024, up from 97.7 in the fourth quarter of 2023.

- The Job Market Opportunity Indicator, reflecting perceptions about job security and the jobs market, held relatively steady again at 98.8 in the first quarter of 2024 as compared to 98.2 for the fourth quarter of 2023.

- Although the Employee Retention Index signals decreasing attrition in the months ahead, employers should exercise caution. Economic conditions often swing, which can impact quits. Employers also can be mindful that Index Indicators – organizational culture and confidence – are the two areas where employers can most readily intervene and drive positive impact.

Each month, the Eagle Hill Consulting Employee Retention Index forecasts shifts in workforce retention based upon ongoing employee opinion surveys on factors that directly correlate with employees’ intentions to make job moves:

- The Organizational Confidence Indicator measures how confident employees are in their organization’s future and leadership.

- The Culture Indicator looks at employee sentiment about their workplace culture, connections, and whether they feel valued and recognized.

- The Compensation Indicator measures how employees view their compensation, benefits, and ability to grow their compensation at their organization.

- The Job Market Opportunity Indicator measures how employees perceive external prospects for employment and job security in the near term.

As the Employee Retention Index increases, it signals an increase in retention in the next six months. As the Employee Retention Index decreases, it signals to employers that workers are more likely to leave their jobs, and organizations can expect more turnover in the next six months.

Understanding employee sentiment at a deep level has evolved into a competitive asset. With this new proprietary market indicator, employers have forward-looking insights to help proactively implement strategies to manage their workforce. While the Eagle Hill Employee Index isn’t a one-size-fits all for employers, organizations can use it to benchmark their organization and pinpoint their strengths and weakness. In doing so, employers can assess and make changes to ensure their workforce is motivated, engaged, and aligned with the organizational mission.

Results are released on a quarterly basis, including an annual summary report. Conducted by Ipsos, the Eagle Hill Employee Retention Index is a nationally representative sample of adults ages 18 and older who are employed full-time or part-time on a range of workforce topics. Survey data is collected on a monthly basis, which commenced in December 2022. The most recent data was collected from March 1-4, 2024.

Eagle Hill Consulting LLC is a woman-owned business that provides unconventional management consulting services in the areas of Strategy, Performance, Talent, and Change. The company’s expertise in delivering innovative solutions to unique challenges spans across the private, public, and nonprofit sectors. A leading authority on employee sentiment, Eagle Hill is headquartered in the Washington, D.C. metropolitan area, with employees across the U.S. and offices in Boston and Seattle. More information is available at www.eaglehillconsulting.com.

Media Contact: Susan Nealon | 703.229.8600 | snealon@eaglehillconsulting.com | @WeAreEagleHill